Global trading overview - Q1 2024 in review

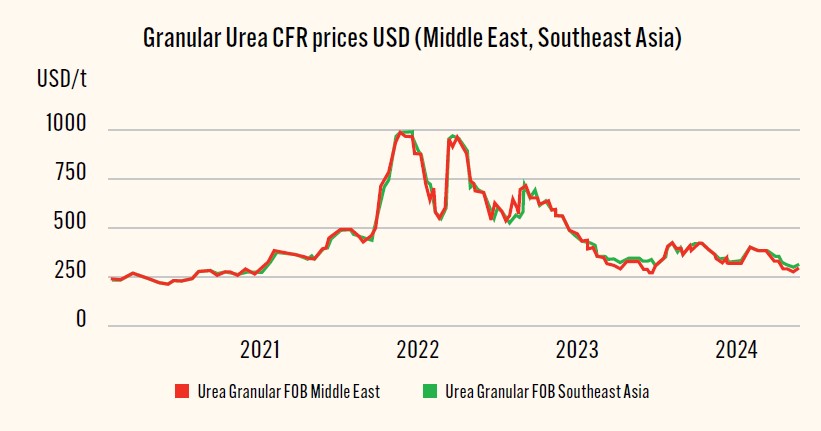

In recent months, global prices for nitrogen and Ammonium Phosphate (AP) have either plateaued or reduced.

Lower nitrogen prices have been driven largely by lower demand from India. The lower AP price is a response to short-term increase in global supply, particularly from China. Geopolitical tensions in the Red Sea have continued in recent months.

Ship owners are avoiding the area and detouring via South Africa. This is keeping freight costs high, and they are expected to stay at these levels for the next few months.

Port congestion, particularly at Newcastle and Geelong, has led to bulk vessels experiencing delays in getting a berth. Our Shipping and Planning teams have been working to optimise port calls and rotations to reduce delay and cost as much as possible.

Nitrogen

- Nitrogen production across South East Asia continues to be challenged by unexpected plant downtimes, reducing supply from these markets.

- The market continues to watch for export to restart from China. This was anticipated to begin in May, but strong domestic prices in China suggest this will be delayed to Q3 2024.

Source: Argus

Ammonium Phosphate (AP)

- Lower AP prices in some markets is a response to a short-term increase in global supply, particularly from China, which has outstripped demand in the same window.

- Meanwhile, inventory in key markets like Pakistan, India and the United States remains low and the demand outlook is strong. This suggests the current period of lower prices may be brief.

Source: Argus

*Current as at time of publication

Looking ahead

- After a period of abundant supply, tighter supply and demand dynamics in the AP market will probably return and become more acute as seasonal demand becomes clear in key markets of Asia, the United States and Brazil in late Q2 2024.

- Geopolitical tensions, including unrest in the Middle East, war in Ukraine and the US Presidential Election will mean the AP and nitrogen markets remain relatively volatile.

- As with Q4 2023, market participants will continue to closely watch Crude Oil markets for conflict related disruptions and their potential to pressure fertiliser prices.

- Key crop prices are volatile which impacts growers’ terms of trade. While there has been a reduction in some prices, generally they remain above the most recent cyclical lows.

Price risk in response to all the above factors will continue to be volatile, however key indicators point to a period of lower prices

followed by greater stability and a possible price increase during late Q2 and Q3.

Disclaimer:

The information provided in this publication is intended for general informational purposes only. While Incitec Pivot Fertilisers (IPF) strives to offer accurate and up-to-date content, it is important to note that the information contained herein should not be considered as professional advice or recommendations. Our company and its authors do not accept any responsibility or liability for any loss, damage, injury, or inconvenience arising from the use or reliance upon the information contained in this publication. The use of any product, method, or practice discussed in this publication is at the reader's own discretion and risk. It is essential to follow local regulations, guidelines, and best practices in your specific region when making decisions related to agronomy, fertilisation, or any other agricultural practices. By accessing and using this publication, you acknowledge and agree to the terms of this disclaimer and release our company, its authors, and contributors from any liability associated with the use or misuse of the information presented herein.